R&D Tax Credits For The Medtech Sector

Get the sector experience you need to make a successful R&D tax relief claim

QLC helps medtech engineering companies accelerate their R&D claims with our streamlined portal and expert team.

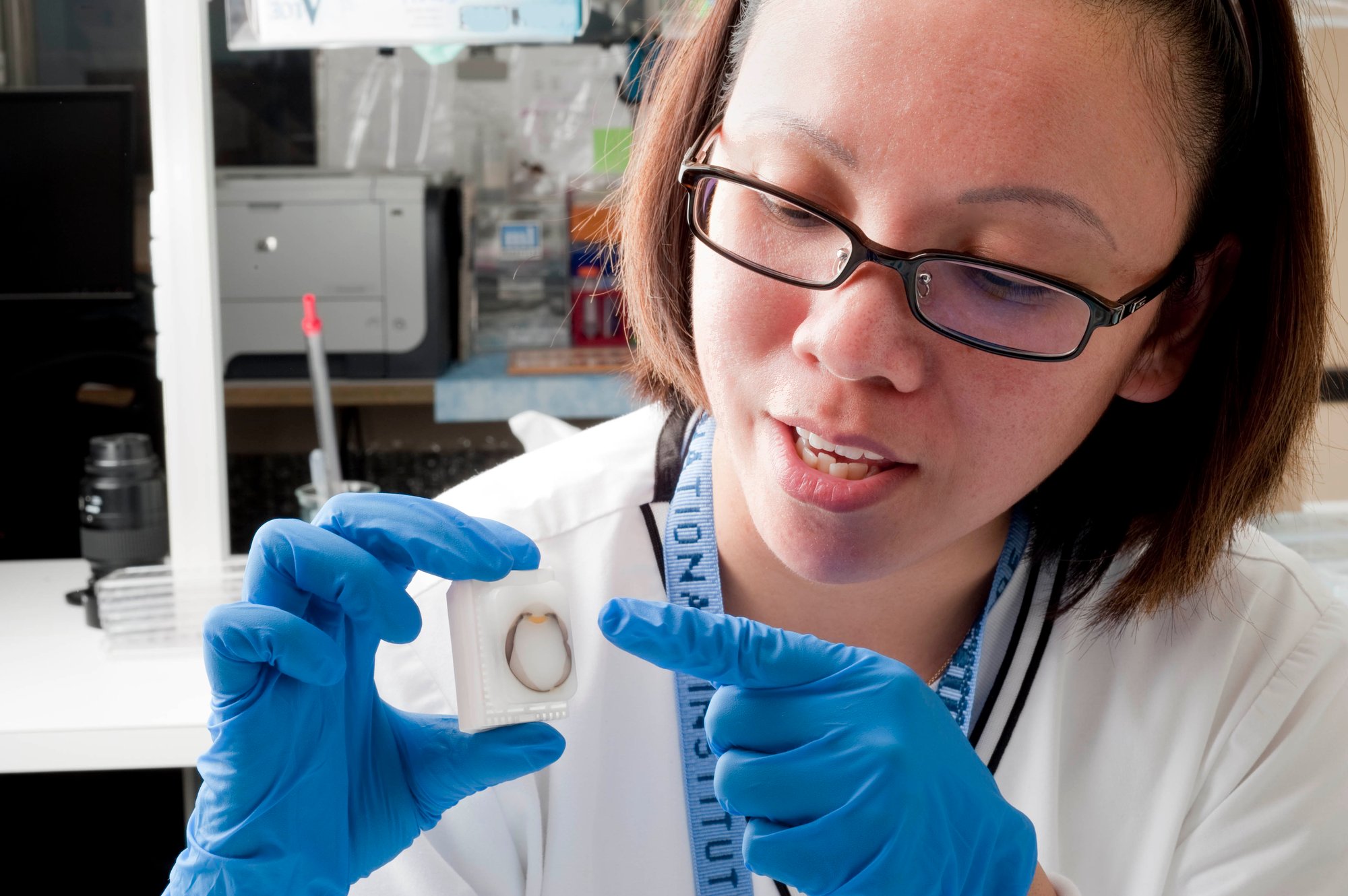

Our medtech experience

With years of expertise in medtech R&D tax relief, QLC understands the unique challenges of your industry. Whether you're developing innovative medical devices, enhancing healthcare software, or advancing diagnostic technologies, we’ve supported medtech companies of all sizes in claiming millions through R&D tax credits. Trust QLC to help your business unlock the benefits you deserve.

Find out more in our engineering sector success stories below:

Success stories

What Our Clients Say About Us

"I am really impressed with the efficiency of your work, and the results you got for our company. A very friendly, committed and obviously hardworking team. You made the whole process very easy."

Will Tompkins (Director)

Vintage and Classic Cars

"QLC successfully claimed credits for the past 2 financial years, this year was even better. They managed the application and claimed the R&D credit prior to our annual tax bill, making the whole process quicker, easier and more efficient than last year."

Andrew Forbes (Director)

Architecture

"A massive thanks to all your team, obviously with the current situation, this money couldn’t have come at a better time."

Ian Cooke (Director)

Engineering

"From our experience we have always found QLC to be efficient and thorough in their tax appraisals, carefully guiding us through the often complex process. They have a very approachable team, all of which have been able to offer excellent advice when needed."

Ben Reed (Director)

Architecture

"They are proactive and efficient in performing their service and I have been impressed by their dynamism."

Chris Wright (Director)

Motorsport Engineering

"Your company did exactly what you said it would do. It took far less time than the other company that we had used in the past. We are extremely pleased with the outcome."

Adrian Smith (Company Sec)

Manufacturing Firm

"I am really impressed with the efficiency of your work, and the results you got for our company. A very friendly, committed and obviously hardworking team. You made the whole process very easy."

Will Tompkins (Director)

Vintage and Classic Cars

"QLC successfully claimed credits for the past 2 financial years, this year was even better. They managed the application and claimed the R&D credit prior to our annual tax bill, making the whole process quicker, easier and more efficient than last year."

Andrew Forbes (Director)

Architecture

"A massive thanks to all your team, obviously with the current situation, this money couldn’t have come at a better time."

Ian Cooke (Director)

Engineering

"From our experience we have always found QLC to be efficient and thorough in their tax appraisals, carefully guiding us through the often complex process. They have a very approachable team, all of which have been able to offer excellent advice when needed."

Ben Reed (Director)

Architecture

"They are proactive and efficient in performing their service and I have been impressed by their dynamism."

Chris Wright (Director)

Motorsport Engineering

"Your company did exactly what you said it would do. It took far less time than the other company that we had used in the past. We are extremely pleased with the outcome."

Adrian Smith (Company Sec)

Manufacturing Firm

How much could you claim?

The average R&D tax claim for an SME

For your own quick estimate, you can use our easy-to-use R&D tax calculator:

£ 55 k

Common R&D activities in the medtech sector

Medical device development

Designing and prototyping innovative medical devices or equipment.

Developing wearable health-monitoring technologies (e.g., smartwatches, biosensors).

Improving existing medical devices to enhance performance, reliability, or usability.

Creating implantable devices or prosthetics with advanced materials or technologies.

Developing devices for minimally invasive surgeries.

Healthcare software and digital solutions

Creating diagnostic software powered by AI or machine learning.

Developing electronic health record (EHR) systems with enhanced functionality.

Designing patient monitoring systems for remote healthcare.

Developing telemedicine platforms or apps to improve access to care.

Enhancing healthcare analytics tools for real-time data interpretation.

Diagnostics and testing

Developing innovative diagnostic methods or tools (e.g., PCR testing technologies).

Improving accuracy or speed in existing diagnostic equipment.

Creating point-of-care diagnostic solutions for quicker results.

Researching and testing new biomarkers for disease detection.

Enhancing imaging technologies (e.g., MRI, CT, or X-ray systems).

Biotechnology and pharmaceuticals

Developing drug delivery systems for targeted therapies.

Creating bio-compatible materials for medical use.

Enhancing vaccine development processes or technologies.

Innovating tissue engineering or regenerative medicine techniques.

Researching advanced bioprinting methods for organ or tissue creation.

Robotics and automation

Designing robotic-assisted surgery systems.

Developing automated lab testing systems.

Creating robotic devices for patient rehabilitation.

Innovating robotic platforms for medication dispensing.

Researching and testing robotics for assisted living technologies.

Materials development

Researching biocompatible materials for medical applications.

Developing antimicrobial surfaces for medical devices or hospital environments.

Enhancing materials to improve durability or reduce allergic reactions.

Creating sustainable or biodegradable materials for disposable medical products.

Investigating advanced composites for lightweight medical devices.

AI and machine learning applications

Developing AI models for predicting patient outcomes or disease progression.

Creating machine learning algorithms for personalised medicine.

Enhancing computer-aided diagnostics or image recognition in radiology.

Innovating AI-powered tools for automated reporting and compliance.

Using machine learning for optimising clinical workflows.

Surgical and therapeutic innovation

Developing new surgical instruments or tools.

Innovating techniques for non-invasive or minimally invasive treatments.

Designing therapy delivery systems for advanced medical treatments.

Researching solutions for real-time intraoperative guidance.

Testing and validating new surgical methods or tools.

Clinical trials and validation

Conducting feasibility studies for new medical devices.

Testing the safety and efficacy of innovative healthcare solutions.

Developing new protocols for device validation or certification.

Addressing challenges in scaling up prototypes for clinical use.

Collecting and analysing real-world data for post-market surveillance.

Other activities

Regulatory compliance and testing

- Developing systems to meet regulatory requirements (e.g., FDA, CE marking).

- Researching and implementing new sterilisation methods.

- Ensuring compliance with standards for biocompatibility or safety.

- Designing testing protocols for product certification.

- Validating new materials, devices, or systems against regulatory benchmarks.

Sustainability in medtech

- Innovating sustainable manufacturing processes for medical devices.

- Researching recyclable or biodegradable materials for disposables.

- Reducing energy consumption in device production or operation.

- Developing eco-friendly packaging for medical products.

- Exploring reusable alternatives for single-use medical tools.

Emerging technologies

- Researching and integrating quantum computing for advanced diagnostics.

- Developing tools for augmented reality (AR) in surgical training or guidance.

- Exploring nanotechnology applications in targeted drug delivery.

- Creating Internet of Medical Things (IoMT) devices for interconnected care.

- Innovating 3D printing methods for patient-specific implants or models.

Why choose QLC?

QLC and our portal help businesses like yours claim R&D tax credits and tax relief faster and more successfully than ever.

End-to-end service

Easy-to-use customer portal

Faster payouts than our competitors

See your money in 16 days

Flexible comms

All sectors and sizes

No minimum fee

Stakeholder transparency

Medtech Sector R&D Tax Credit FAQ

What medtech activities qualify for R&D tax relief?

Activities that typically qualify include:

- Developing new medical devices or improving existing ones.

- Creating healthcare software or AI-driven diagnostic tools.

- Enhancing surgical techniques or therapy delivery systems.

- Researching and testing biocompatible or antimicrobial materials.

- Addressing technical challenges in regulatory compliance, such as CE marking or FDA approval.

Do clinical trials and validation activities qualify for R&D tax relief?

Yes, clinical trials and validation activities qualify if they involve resolving technical uncertainties or systematically testing innovative solutions. Activities like testing new devices, improving protocols, or addressing scaling challenges are often eligible.

Are projects aimed at meeting regulatory compliance standards eligible?

Yes, if the compliance work involves innovation or solving technical challenges, such as developing novel sterilisation methods or biocompatibility testing.

Can we claim for failed or incomplete projects?

Absolutely. R&D tax relief applies to projects that attempted to resolve technical uncertainties, regardless of their success.

What costs can medtech companies include in their R&D tax relief claims?

Eligible costs include:

- Staff costs (salaries, pensions, NICs) for employees involved in R&D.

- Consumables, such as materials used in prototyping or testing.

- Software licenses directly related to R&D.

- Subcontractor costs (up to 65% of the eligible amount).

- Costs for trials, testing, and validation.

Can we claim for equipment costs?

Equipment costs are typically not eligible unless they are consumable or directly used in the R&D process (e.g., prototype components).

Are costs for third-party consultants or contractors eligible?

Yes, subcontractor costs can be included at 65% of the qualifying expenditure, provided they contribute directly to R&D activities.

Can training costs for employees involved in R&D be claimed?

No, training costs themselves are not eligible. However, the time employees spend applying that training to R&D activities is.

Are costs for regulatory approvals eligible?

Costs related to obtaining regulatory approvals may qualify if they involve resolving technical uncertainties or innovation.

What documentation is required for an R&D tax relief claim?

Key documentation includes:

- Detailed project reports explaining the technical challenges and uncertainties addressed.

- Records of time spent by employees on R&D activities.

- Financial records of eligible costs (e.g., invoices, payroll).

- Evidence of testing, prototypes, and results from trials.

How far back can we claim R&D tax relief?

Claims can be made for the previous two financial years.

Do sustainability-focused medtech projects qualify?

Yes, projects that develop sustainable materials, reduce energy consumption, or explore biodegradable options for medical devices often qualify.

Are bioprinting and regenerative medicine projects eligible?

Absolutely. Research and development in tissue engineering, bioprinting, and regenerative medicine often involve significant technical challenges and qualify for relief.