Sector experience

QLC have extensive experience working with a broad range of sectors. This means we know exactly how to develop successful claims that bear fruit, quickly and with minimum fuss.

Pharmaceutical & Medtech

Agriculture

Food & Drink

Manufacturing

Architecture

AI & Robotics

Construction

Computing & Technology

Textiles

Software Development

Engineering

Waste Management

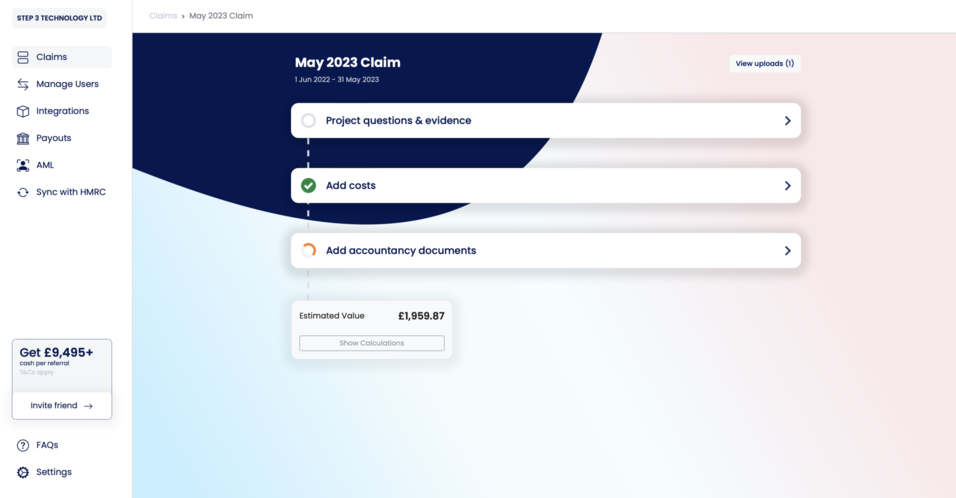

R&D Tax Relief Calculator

Calculating how much R&D tax relief you can claim is complex and involves assessing eligible projects and expenditure in detail. However, for a quick estimate, you can use our easy-to-use R&D tax calculator. By answering a few quick questions about your R&D expenses and tax position, you’ll get an instant estimate of the tax relief your business may be eligible for.

Get started now to discover your R&D tax relief potential.

Disclaimer: this is not a guarantee and other factors will affect how much you can actually receive. For more information, contact us.

R&D Calculator

Calculate your company's R&D tax relief quickly and easily

start date:

end date:

days:

expenditure:

profit/loss:

companies:

Your estimated tax benefit from R&D activities is:

This is an estimated value of the tax credits your company may qualify for.

Processing and emailing your results...