Why did we build an R&D Gateway tax incentive portal?

Champions of small business

We started Queens Lane Consultancy to help small businesses benefit from R&D tax credits online and make the process as simple as possible. Of course, businesses of any size are allowed to make R&D tax claims, but, in reality, it is predominantly big businesses that have the resources to do so.

Smaller businesses are less likely to have teams of accountants who have the time or experience to create and submit claims to HMRC. Indeed, many R&D companies have minimum fees that effectively stop small companies from claiming altogether. This means that thousands of innovative companies across the UK cannot claim back the money and time they invest in new ideas, people, products and services.

Until now.

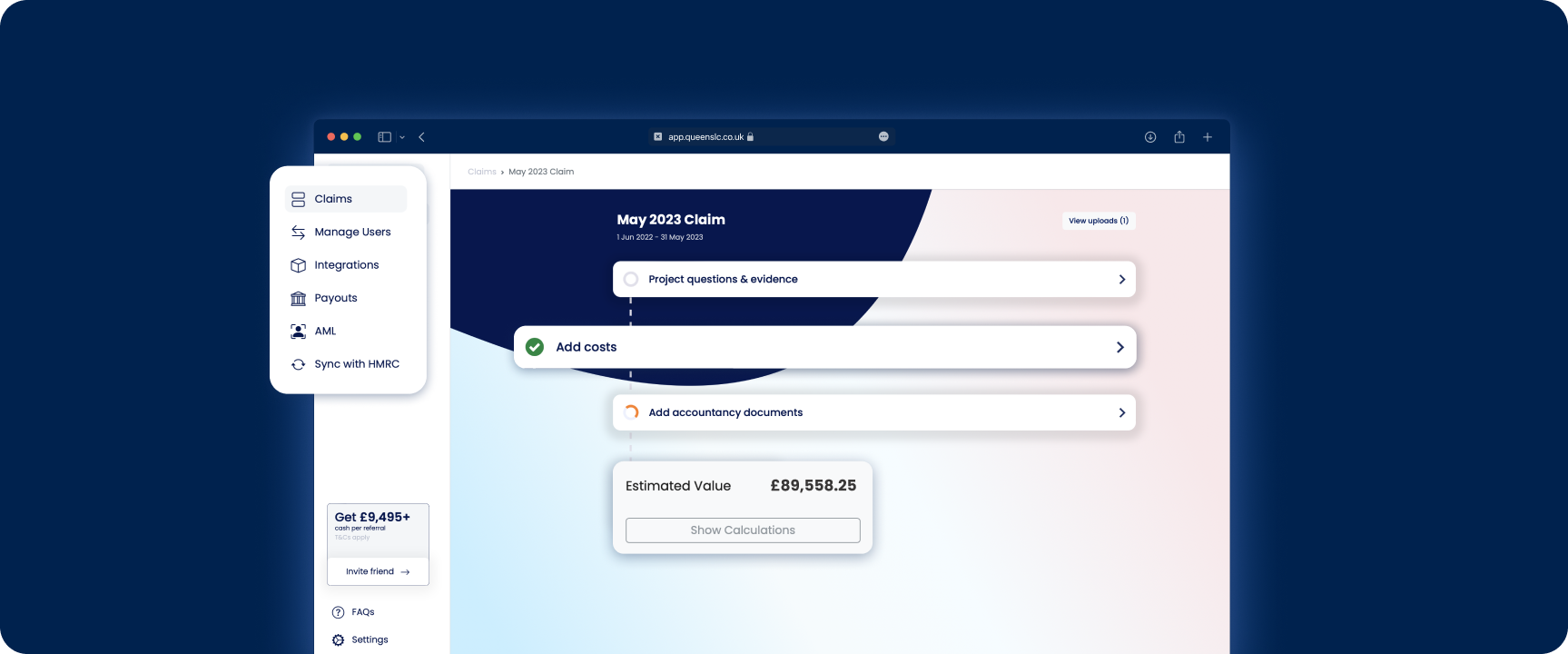

A portal for the people

The QLC R&D Gateway Portal, featuring R&D tax credit internal use software, makes it quick and easy for companies to claim R&D tax credits without hours of back and forth. By asking for specific information, the portal structures claims using R&D tax credit software that is more successful and arrives quicker than the industry average.

We’re proud of the hundreds of small businesses across the UK that we have helped receive tax credits. We’re proud to help these companies reinvest this money back into their businesses, helping them innovate further.

And we’d be proud to help you claim back the money you’ve invested in R&D.