You don’t need to worry about any of this……

because we’ll help you with your tax credit claim from end to end and make sure you get the maximum relief.

SME R&D Tax Credit FAQ

What are SME R&D tax credits?

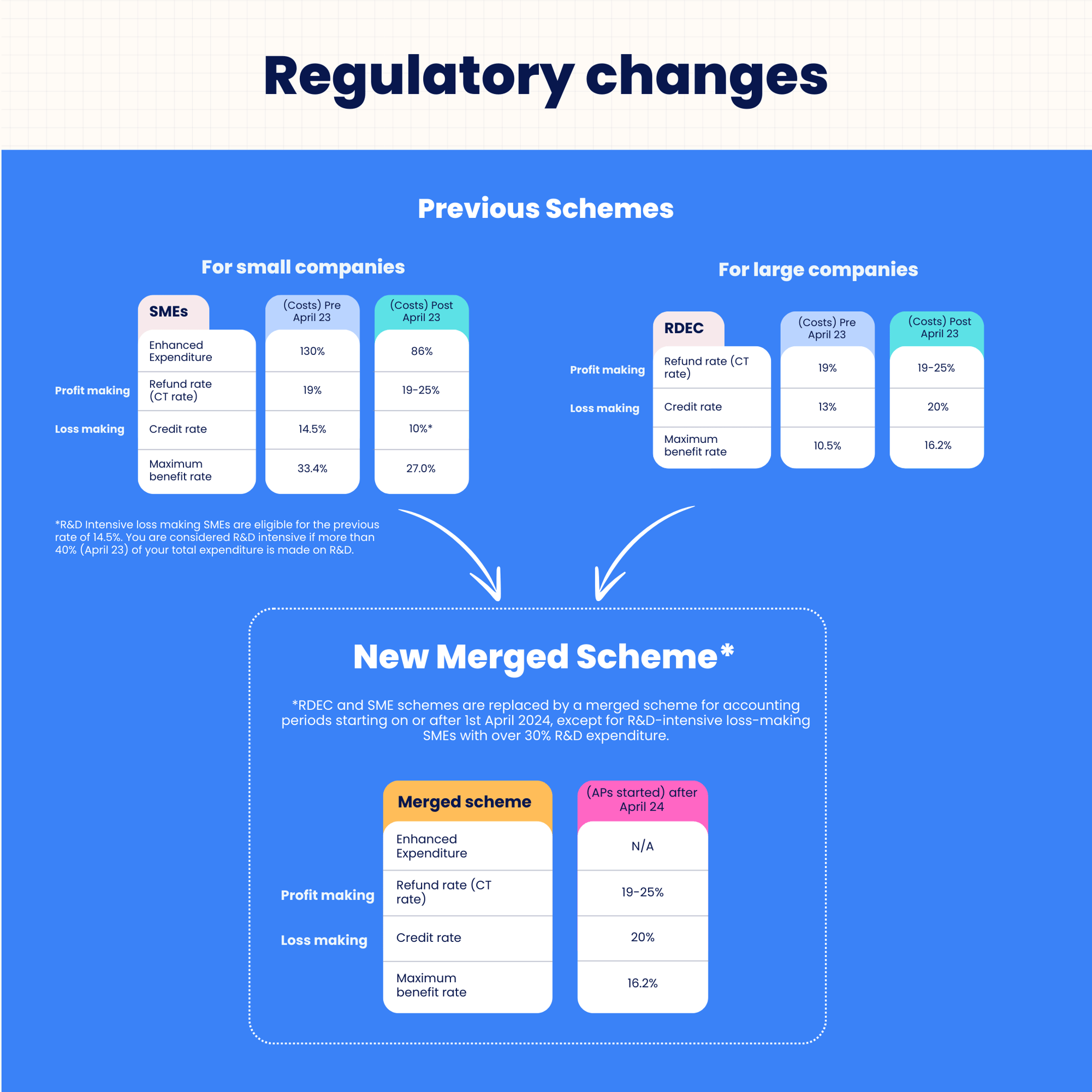

SME R&D tax credits are a government incentive designed to help small and medium-sized enterprises claim back some of the money they’ve invested in research and development (R&D) activities. These credits can significantly reduce your corporation tax or provide a cash refund if your company is loss-making.

How do I know if I qualify for SME R&D tax credits?

To qualify for SME R&D tax credits, your company must have fewer than 500 employees and either an annual turnover below £100 million or a balance sheet total under £86 million. Additionally, your R&D activities must aim to advance science or technology in your industry. Note that connected or partner companies may impact your classification.

My company has been paid by a large company to do R&D, can I still claim?

Yes, SMEs that perform R&D work for large companies may still claim R&D tax credits, but the type of credit available and the amount may vary. When working on subcontracted R&D projects for large businesses, it’s important to clarify the rules to ensure you can claim under the correct scheme.