Get your RDEC R&D tax credit claim processed quickly and easily

Unlock your R&D investment with our fast, easy and highly successful R&D tax credit claims service for RDEC. We manage, draft, submit, and defend R&D tax credit claims for innovative RDEC Leveraging our in-house expertise and proprietary technology, we have unlocked millions in R&D tax relief for small- and medium-sized UK companies, ensuring you receive the maximum benefit from your R&D activities.

High claim success rate

Get your claim within 16 days

Easy and efficient process

No minimum fee

Large company R&D Tax Relief Calculator

Calculating how much R&D tax relief you can claim is complex and involves assessing eligible projects and expenditure in detail. However, for a quick estimate, you can use our easy-to-use R&D tax calculator. By answering a few quick questions about your R&D expenses and tax position, you’ll get an instant estimate of the tax relief your business may be eligible for.

Get started now to discover your R&D tax relief potential.

Disclaimer: this is not a guarantee and other factors will affect how much you can actually receive. For more information, contact us.

R&D Calculator

Calculate your company's R&D tax relief quickly and easily

start date:

end date:

days:

expenditure:

profit/loss:

companies:

Your estimated tax benefit from R&D activities is:

This is an estimated value of the tax credits your company may qualify for.

Processing and emailing your results...

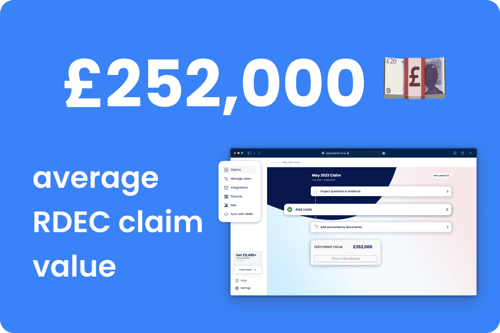

Supporting large company R&D tax credit claims

The QLC Portal makes it quick and easy for companies to claim R&D tax credits without the need for large teams of specialist accounts.

By asking for specific information, the portal structures claims that are more successful and arrive quicker than the industry average.

What is RDEC?

The Research and Development Expenditure Credit (RDEC) is a UK government tax incentive designed to encourage large companies to invest in research and development.

Unlike the SME R&D tax credit scheme, RDEC provides a credit based on a percentage of the company's qualifying R&D expenditure, which is currently set at 20%. This credit can either reduce the company's corporation tax liability or result in a cash payment.

RDEC is available to large companies, those exceeding the SME threshold, and can also be claimed by smaller companies subcontracted to perform R&D work for larger businesses.

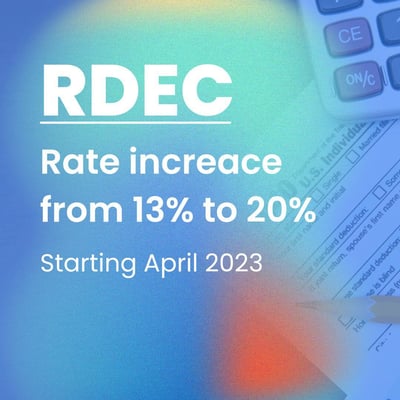

Changes to RDEC

Recent changes to the Research and Development Expenditure Credit (RDEC) scheme in the UK are set to impact large companies’ R&D tax credit claims.

From April 2023, the government has increased the RDEC rate from 13% to 20%, providing more generous support for businesses investing in innovation. This uplift means that large companies will receive a higher return on their qualifying R&D expenditure, making R&D projects more financially attractive.

The changes aim to boost investment in research and development across the UK economy, helping businesses remain competitive and drive growth in innovation-heavy sectors.

The merged scheme will come into effect for accounting periods beginning on or after 1st April 2024. As it is based on the current RDEC scheme, it will be easy for RDEC claimants to continue to claim.