Welcome to Queens Lane Consultants!

Your fast, friendly and efficient R&D tax credit consultancy.

Founded by Frank Collings, Queens Lane Consultants emerged from a genuine passion for supporting small businesses. Surrounded by small, family run motorsport engineers, Frank recognised how many businesses like his family’s could benefit from R&D tax relief but often lacked access to specialised advisors. QLC was created to bridge that gap, helping small businesses unlock opportunities typically reserved for larger firms.

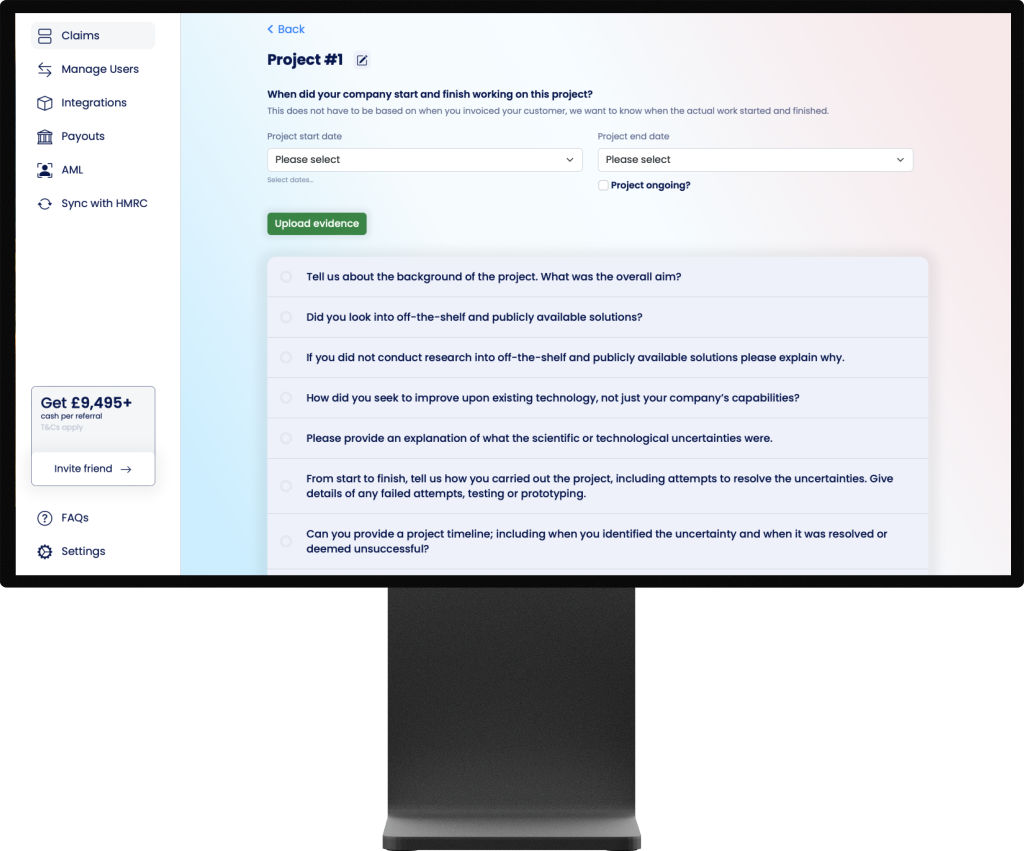

Our mission is to empower businesses of all sizes to access the benefits of R&D tax credits. We believe that innovation should be within reach for every company, not just those with large teams of specialist accountants. That's why we developed the QLC Portal - a streamlined, user-friendly platform designed to make claiming R&D tax credits quick, easy, and efficient.

Our mission

We started Queens Lane Consultants to help small businesses benefit from R&D tax credits.

The QLC Portal makes it quick and easy for companies to claim R&D tax credits without the need for large teams of specialist accounts. By asking for specific information, the portal structures claims that are more successful and arrive quicker than the industry average.

We’re proud of the hundreds of small businesses across the UK that we have helped receive tax credits. We’re proud to help these companies reinvest this money back into their businesses, helping them innovate further.

Why we built our R&D tax incentive portal

Champions of small business

We built the portal to help small businesses benefit from R&D tax credits online and make the process as simple as possible. Of course, businesses of any size are allowed to make R&D tax claims, but, in reality, it is predominantly big businesses that have the resources to do so.

Smaller businesses are less likely to have teams of accountants who have the time or experience to create and submit claims to HMRC. Indeed, many R&D companies have minimum fees that effectively stop small companies from claiming altogether. This means that thousands of innovative companies across the UK cannot claim back the money and time they invest in new ideas, people, products and services.

Until now.

A portal for the people

The QLC Portal, featuring R&D tax credit internal use software, makes it quick and easy for companies to claim R&D tax credits without hours of back and forth. By asking for specific information, the portal structures claims using R&D tax credit software that is more successful and arrives quicker than the industry average.

We’re proud of the hundreds of small businesses across the UK that we have helped receive tax credits. We’re proud to help these companies reinvest this money back into their businesses, helping them innovate further.

And we’d be proud to help you claim back the money you’ve invested in R&D.

Meet Our Team

Frank Collings

Managing Director

Harriet Collings

Head of Business Development

Katy Lane

Chief Operating Officer

Managing Director

Frank Collings

QLC’s founder is an Oxford University alumnus with experience in private equity, noise-cancellation technology, and startups. As a technology entrepreneur, Frank developed the QLC portal to help other businesses reinvest in innovation.

Head of Business Development

Harriet Collings

With extensive leadership and management skills, Harriet leads our sales team, working with new and existing clients to ensure they get the very best experience and results. She also helps our clients develop new revenue streams.

Chief Operating Officer

Katy Lane

Katy has a long history of working with startups and brings expert account analysis skills to QLC clients. Her experience includes financial reports for more than 1,000 claims. She oversees all our current submissions.